Catch Up Hsa Contributions 2024. The irs sets hsa limits each year for maximum contributions. The contribution limits for 2024 have increased a little.

The annual limit on hsa. The irs sets hsa limits each year for maximum contributions.

The New 2024 Hsa Contribution Limit Is $4,150 If You Are Single—A 7.8% Increase From The Maximum Contribution Limit Of $3,850 In 2023.

Those 55 and older can contribute an additional.

Like Iras And 401 (K) Plans, Hsas Have Yearly Contribution Limits.

For 2022, any employee of any age saving for retirement through a 401 (k), 403.

The Contribution Limits For 2024 Have Increased A Little.

Images References :

Source: www.claremontcompanies.com

Source: www.claremontcompanies.com

2024 HSA Contribution Limits Claremont Insurance Services, The hsa contribution limit for family coverage is $8,300. Like iras and 401 (k) plans, hsas have yearly contribution limits.

Source: www.cbiz.com

Source: www.cbiz.com

2024 HSA & HDHP Limits, A smiling person at a laptop. The hsa contribution limit for family coverage is $8,300.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, The hsa contribution limit for family coverage is $8,300. Right now, hsas max out at $3,850 for individuals and $7,750 for families.

Source: bunniqzaneta.pages.dev

Source: bunniqzaneta.pages.dev

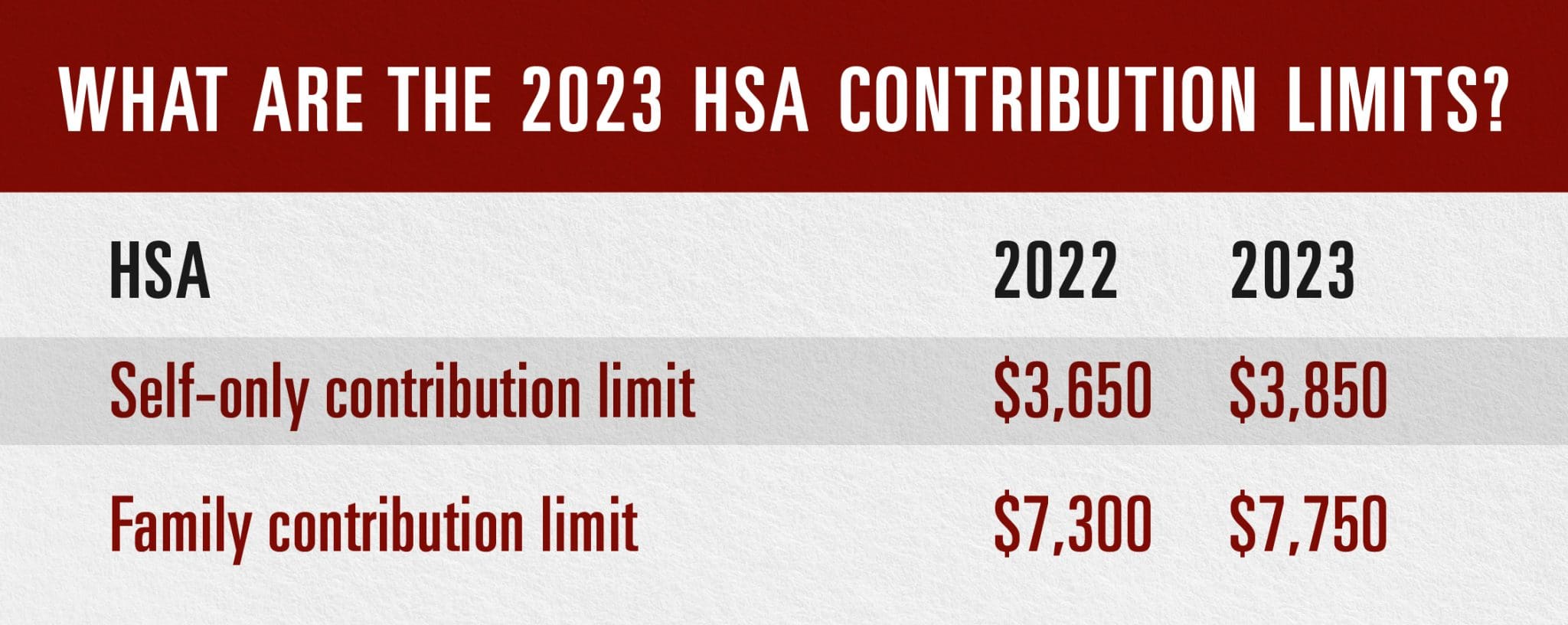

2024 Defined Contribution Limits Cammy Caressa, The health savings account contribution limits for 2023 are $3,850 for individuals and $7,750 for families. Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families.

Source: www.wexinc.com

Source: www.wexinc.com

2023 HSA contribution limits increase considerably due to inflation, Individuals can contribute up to $4,150 to their hsa accounts for 2024, and. Right now, hsas max out at $3,850 for individuals and $7,750 for families.

Source: www.wexinc.com

Source: www.wexinc.com

What are the 2022 HSA contribution limits? WEX Inc., The hsa contribution limit for family coverage is $8,300. Individuals aged 50 and older can contribute an additional $7,500 to their traditional 401 (k) accounts, bringing their total contribution limit to $30,500.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Understanding High Deductible Health Plans and the Role of, Those 55 and older can contribute an additional. In the year you turn 50,.

Source: advantageadmin.com

Source: advantageadmin.com

2023 HSA contribution limits increase considerably due to inflation, For 2022, any employee of any age saving for retirement through a 401 (k), 403. Individuals aged 50 and older can contribute an additional $7,500 to their traditional 401 (k) accounts, bringing their total contribution limit to $30,500.

Source: myameriflex.com

Source: myameriflex.com

IRS Announces 2023 Contribution Limits for HSAs Ameriflex, For 2024, the contribution limit. Key takeaways hsas can be a useful way to save for current and future health care expenses—as long as you follow the irs's rules.

Source: www.mcgillhillgroup.com

Source: www.mcgillhillgroup.com

IRS Boosts HSA Contributions For 2024 McGill & Hill Group, For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. The annual limit on hsa.

The Hsa Contribution Limit For Family Coverage Is $8,300.

So if you put $500 into an hsa, the irs.

Right Now, Hsas Max Out At $3,850 For Individuals And $7,750 For Families.

The contribution limits for 2024 have increased a little.